The digital bank of tomorrow. Here today.

40% higher development productivity

In just three months, you can complete the initial feature set-up for a virtual banking operation. Be quick to enter new markets and cut down operational costs, by leveraging BankLiteX as part of your digital banking strategy.

Collaboration

Developed by GFT in collaboration with Thought Machine, running on AWS, BankLiteX gives you a jump-start to help you reduce the time-to-market, de-risk the project and optimise the return on investment (ROI) of your new digital journey.

A simple and effective solution to your challenges

De-risk projects:

- Pre-defined operating model: digital channels, core functionality and third-party integration on the same cloud infrastructure

- Focus on your Customer Experience (CX) and process-specific requirements

- Deployment in multiple countries with minimal changes

Accelerate time-to-market

- Standardised state-of-the-art business processes

- Distributed teams across time zones

- Data integrity

Become a platform

- Cloud and microservices ready – full security stack included

- Reduced cost of ownership and service availability

- Robust technology stack

Reduce operational costs

- Reduced initial set-up time for first features from six to three months

- Improved development productivity by 40%. New products are ready to deploy in a few days

- Controlled and predictable costs

Flexibility and collaboration by design

Designed with a building block architecture and pluggable components,based on GFT's Digital Bank Launcher

accelerator, and leveraging AWS Cloud Native Services, BankLiteX provides you with a basis to jump-start your digital bank.

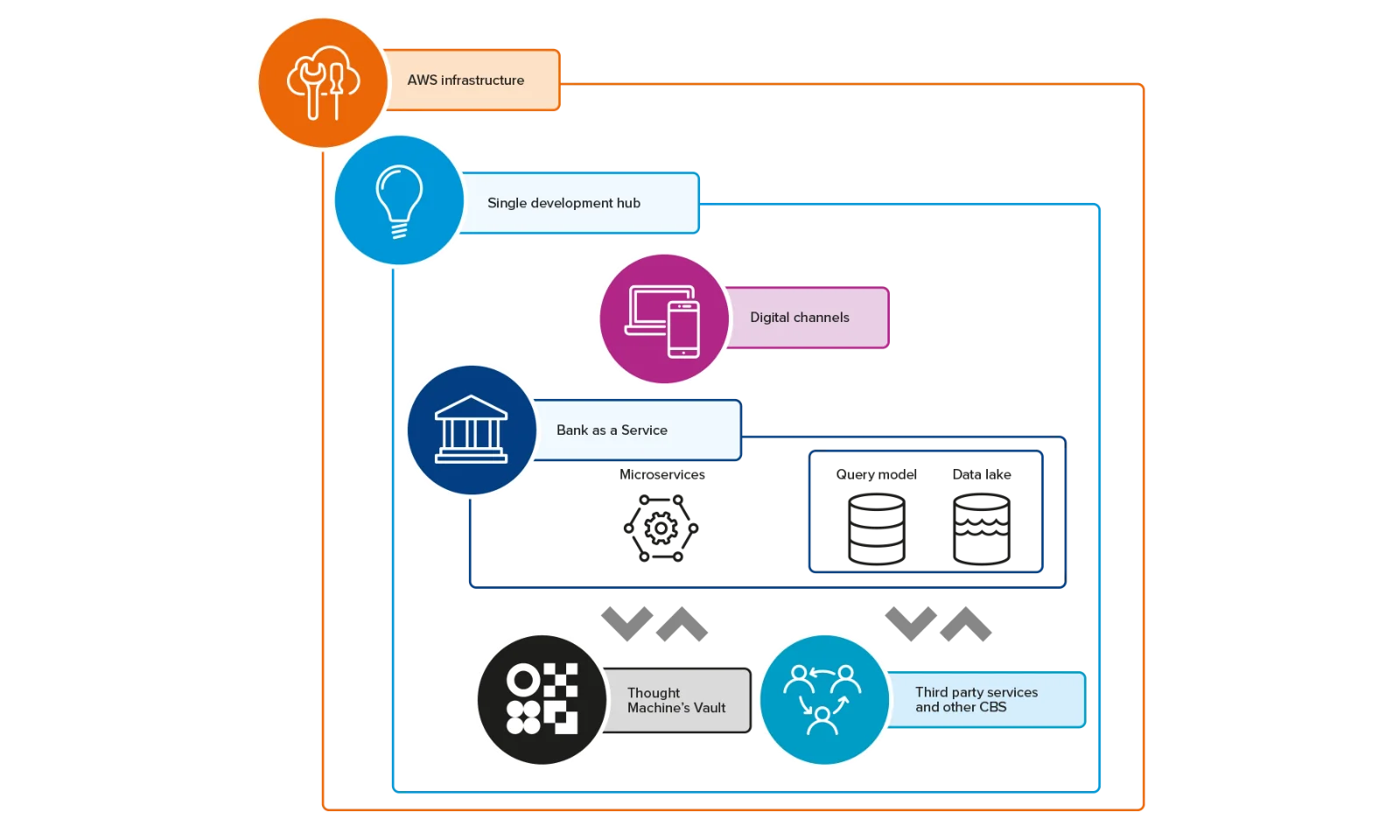

Solutions components

Thought Machine Vault is the core banking component providing the business logic, workflow engine, product management (smart-contracts) and configuration.

AWS provides a secure, scalable and innovative platform in the cloud enabling new digital banks to meet regulatory requirements and develop new business models.

BankLiteX provides all the building blocks to deliver the digital channels, as well as the banking platform to support integrations with external service providers and the fintech ecosystem.

The platform implements an API-based Bank as a Service approach that delivers a seamless service across third-party apps, products,microservices and custom-made software. It also enables a multi-core banking system approach to de-risk migration.

BankLiteX is based on modern technologies enabling collaborative methods to ensure efficiency across business, UI/UX design, DevOps and operations teams.

A single development hub provides a unified repository for all projects, technologies and programming languages – enabling safe collaboration across all teams involved in a business feature.

Ready for the journey?

Setting sail with BankLiteX is simple.

The initial step is a half-day exploratory workshop to understand your current technology landscape and the challenges you are facing.

Whether you want to launch a new bank from scratch,extend your current platform or launch a new standalone service, take the first step and get in touch with us.