- About us

- News

- GFT press releases

- GenAI solution to automate credit memos

GenAI solution to automate credit memos

Benefits

Efficiency

Up to 30-40% time savings in the creation and maintenance of memos by streamlining time-consuming tasks, minimising errors and freeing up analysts' time for value-adding analysis.

Quality and consistency

Minimises human errors and ensures that all memo sections are thoroughly completed. Standardised report, reducing human bias and strictly adhering to company standards.

Transparency

All generated reports are linked to a specific document and provide reliable scores and a record of all changes.

Simplifying a complex task

Creating credit memos in banks involves significant challenges, including ensuring data accuracy and regulatory compliance, conducting thorough risk assessments, and managing interdepartmental coordination. Time management and technological integration are critical for efficiency, while maintaining high quality control standards. These complexities necessitate robust systems and clear communication among all stakeholders involved in the process.

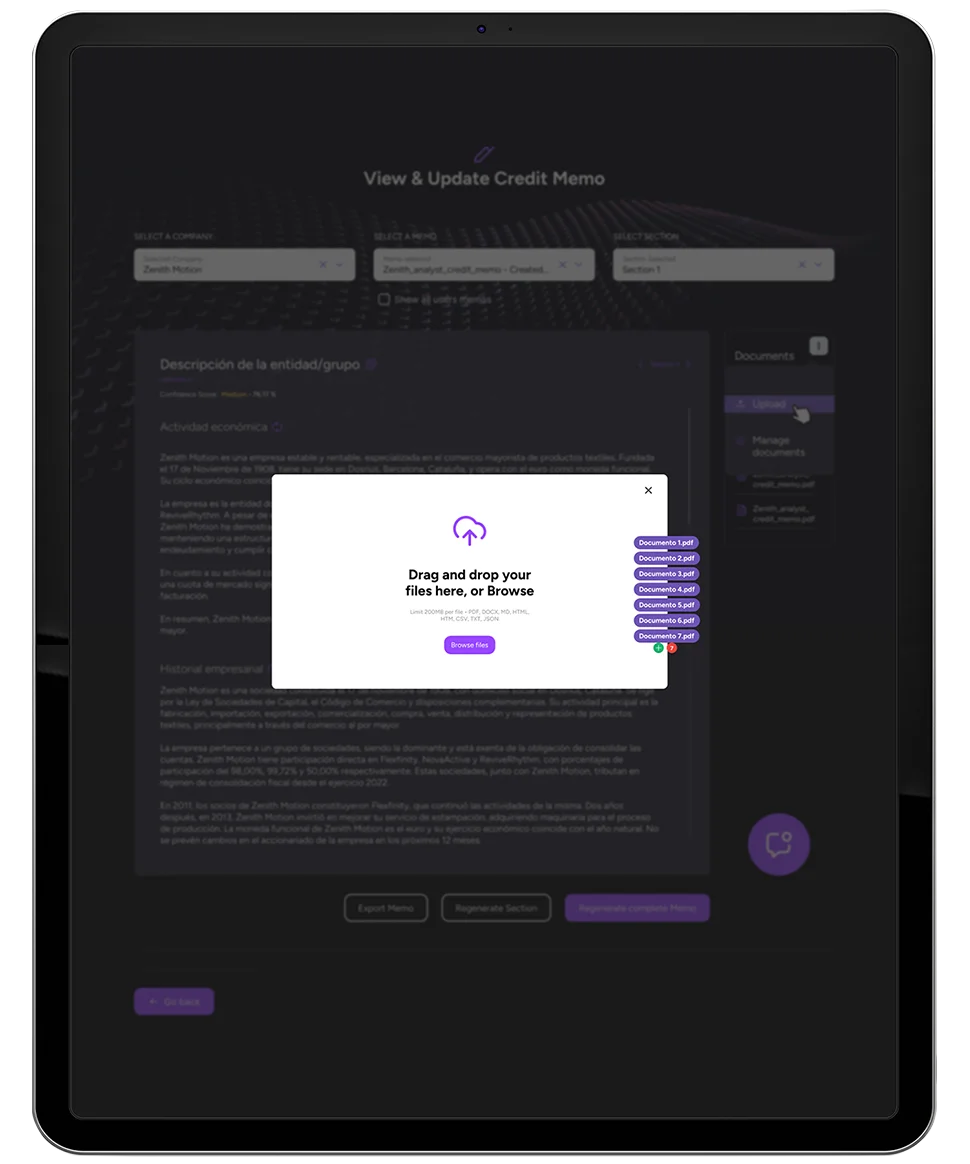

Automatically generate credit memos

The Credit Risk Assistant generates comprehensive multi-language reports within minutes through a user-friendly interface. It collates data from multiple trusted internal and external sources while allowing feedback and refinements by the analyst.

Features

Data and metadata upload and storage

Document generation

Traceability

Human in the loop

Multi-language PDF export

Data and metadata upload and storage

Uploaded files are stored in the cloud. The generated files are stored in the database by sections, and the PDF is generated based on these sections.

Document generation

Traceability

Human in the loop