31 Oct 2023

ICYMI: Understanding how Open Finance impacts sustainable development

Open Finance revolutionizes our approach to banking and making financial decisions. With more access to financial data, organizations have the power to create seamless, personalized experiences for consumers while enabling new heights of innovation.

Carlos Kazuo Missao

Global Head of Innovation Solutions

blogAbstractMinutes

blogAbstractTimeReading

Banking

Customer Experience

Sustainability

Open Ecosystems

Platform Modernization

contact

share

While Open Finance is transforming the banking industry and entering a phase of new modernization and creativity, it’s important to consider the full extent of the practice—such as the power it gives organizations to fully commit to sustainability goals.

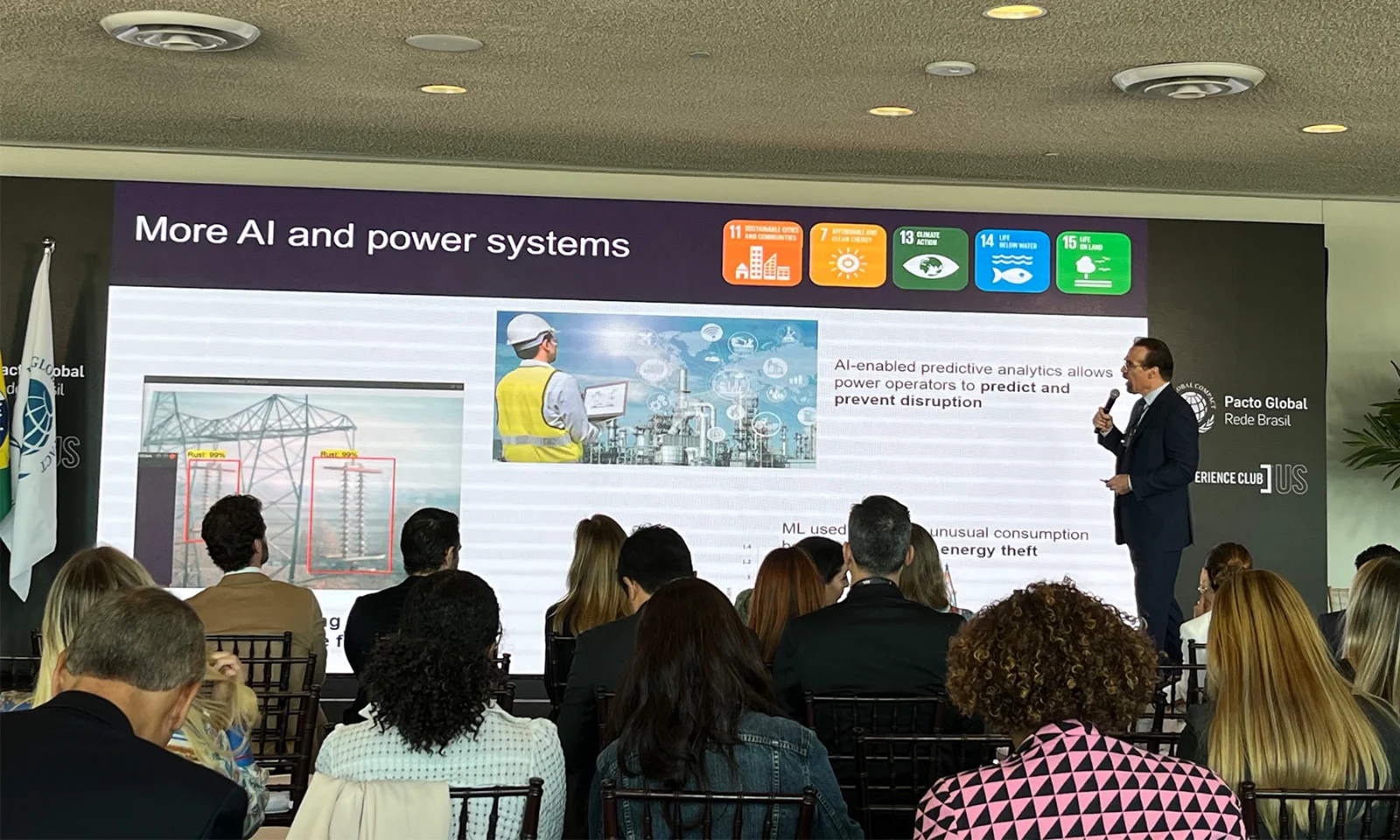

With this in mind, I was grateful to attend the joint Experience Club and United Nations Global Compact event in Manhattan last month. I had the opportunity to join a panel to discuss the intersection of Open Finance and sustainability and partake in several insightful conversations on the impact Open Finance has on our sustainability and inclusivity goals.

Carlos Kazuo Missao

Your expert | Innovation

Global Head of Innovation Solutions

.webp)