16 Aug 2022

Curve Finance – a new era of spot FX on blockchain

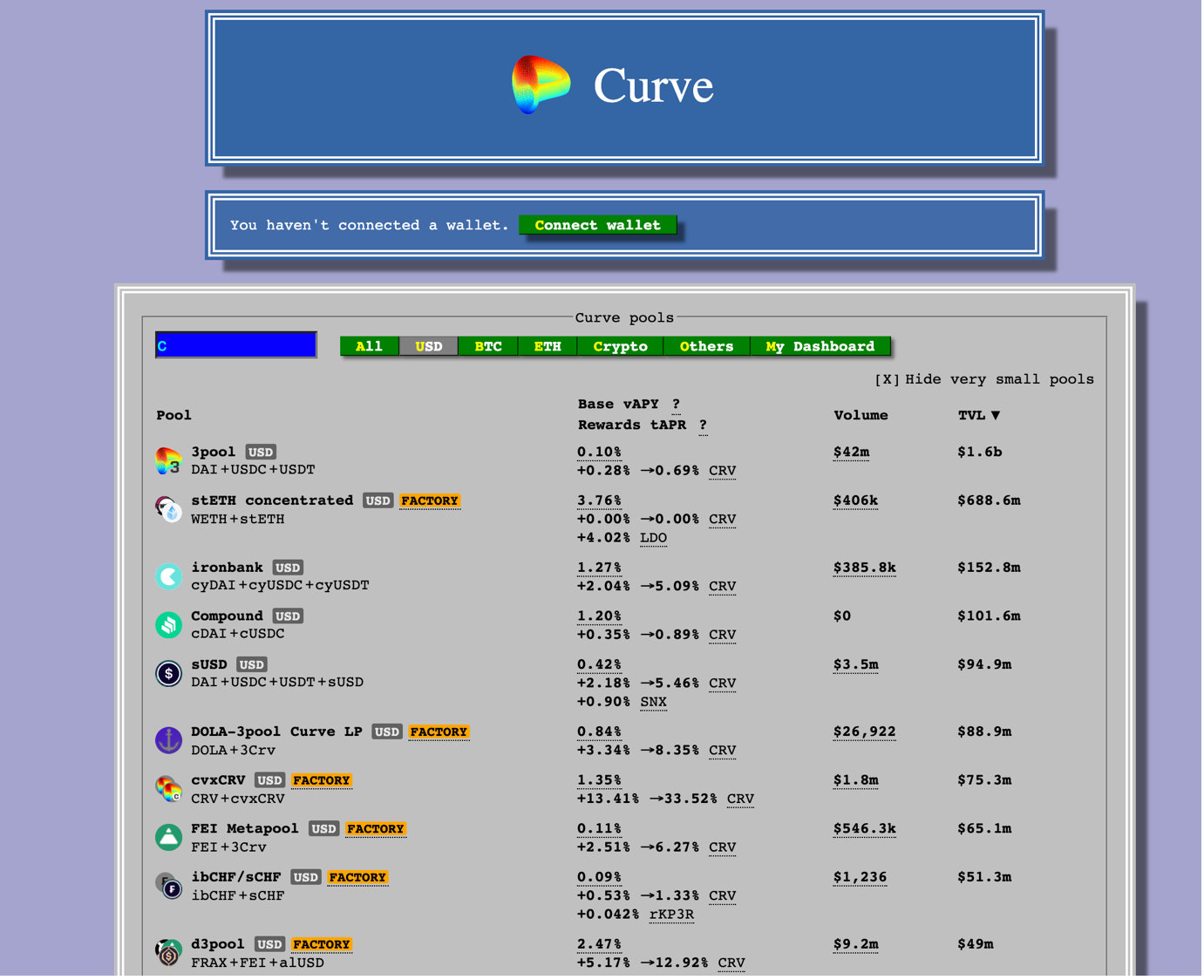

Curve Finance is a permissionless automated market maker (AMM) platform that allows digital assets to be traded using liquidity pools instead of traditional centralised orderbook matching.

Olivier Truquet

APAC Blockchain Lead

blogAbstractMinutes

blogAbstractTimeReading

Banking

Technology Trends

DLT and Blockchain

NextGen Finance

contact

share

Since its launch in early 2020, the Curve Finance platform has grown to become a full-feature decentralised exchange.

Founded as an innovative way to trade in stablecoins as an alternative to more volatile crypto assets, the scope has expanded but the stakeholder benefits are sometimes less clear. This blog explores Curve Finance, the business case for adoption and the role of regulation.